Omdia: MVNO Market on the Rise as Global Subscriptions to Grow 3.6% CAGR by 2029

Omdia: MVNO Market on the Rise as Global Subscriptions to Grow 3.6% CAGR by 2029

LONDON--(BUSINESS WIRE)--The global mobile virtual network operator (MVNO) market is set for steady growth over the next few years, with the number of subscriptions worldwide increasing at a CAGR of 3.6% between the period from 2023 to 2029, according to new forecasts by Omdia.

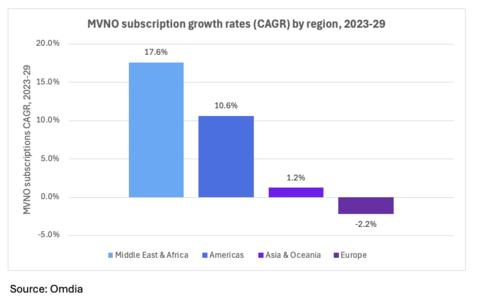

The growth rate for worldwide MVNO subscriptions is more than double the projected CAGR of 1.6% forecasted for personal mobile subscriptions globally over the same period indicating that the MVNO market will outpace the general personal mobile market. However, Omdia expects growth rates to vary widely between major world regions, with MVNO subscriptions poised to expand in the Americas as well as in the Middle East & Africa, while Europe is expected to decline.

Omdia’s MVNO subscriptions forecast covers 47 countries and territories around the world, as well as four major regions and the global market.

MVNO subscriptions in the Americas are expected to increase at a CAGR of 10.6% from 2023 to 2029, led by expansion in Brazil, Mexico, and the US, Omdia forecasts. In the Middle East & Africa, the growth rate will be even stronger, with MVNO subscriptions anticipated to increase at a CAGR of 17.6% from 2023 through to 2029, driven by South Africa and Nigeria. Asia & Oceania will have the biggest MVNO market by subscriptions among major world regions throughout the forecast period, but MVNO subscription growth in this region will be modest.

Although Europe is one of the most advanced regional MVNO markets, Europe’s MVNO subscriptions will contract over the next few years, due to factors such as competition from operator sub-brands and because some MVNOs have decided to deploy their own mobile networks.

“Banks, supermarkets, and broadband and TV service providers continue to be key players in the MVNO market, partly because they can promote mobile services efficiently to their existing customers,” said report author Matthew Reed, Chief Analyst, Service Providers and Markets, at Omdia. “And adding a mobile service to their product range can help these providers to increase customer engagement, retention, and revenue.”

Omdia’s MVNO forecasts are accompanied by a new report, MVNO Market Outlook – 2025, which analyzes MVNO market trends.

ABOUT OMDIA

Omdia, part of Informa TechTarget, Inc. (Nasdaq: TTGT), is a technology research and advisory group. Our deep knowledge of tech markets combined with our actionable insights empower organizations to make smart growth decisions.

Contacts

Fasiha Khan- fasiha.khan@omdia.com